Clean energy capital exists, but it doesn’t flow where it’s needed most.

Resulting in capital friction, missed timelines, and unrealized impact.

Supported by

Customers

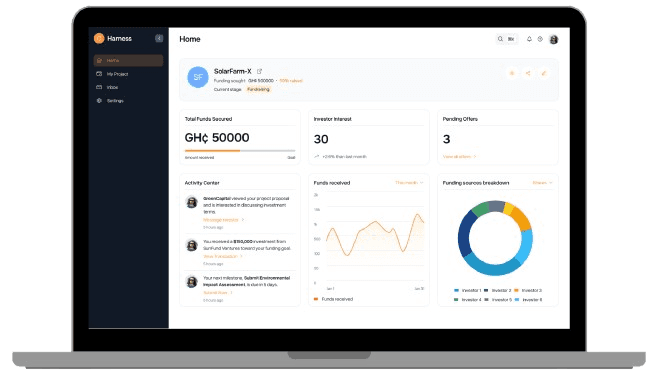

Harness turns complex project information into clear, decision-ready signals for investors.

1

Renewable Energy Developers

Raise capital faster, reduce back-and-forth, and focus on building projects.

1

Renewable Energy Developers

Raise capital faster, reduce back-and-forth, and focus on building projects.

1

Renewable Energy Developers

Raise capital faster, reduce back-and-forth, and focus on building projects.

2

Investors & Funds

Access curated deal flow, clearer risk signals, and scalable deployment opportunities.

2

Investors & Funds

Access curated deal flow, clearer risk signals, and scalable deployment opportunities.

2

Investors & Funds

Access curated deal flow, clearer risk signals, and scalable deployment opportunities.

3

DFIs & Strategic Partners

Strengthen local markets and crowd in private capital more effectively.

3

DFIs & Strategic Partners

Strengthen local markets and crowd in private capital more effectively.

3

DFIs & Strategic Partners

Strengthen local markets and crowd in private capital more effectively.

Harness Due Diligence

Project Intake

Developers submit technical, financial, and contextual project data through a structured workflow.

Project Intake

Developers submit technical, financial, and contextual project data through a structured workflow.

Project Intake

Developers submit technical, financial, and contextual project data through a structured workflow.

Risk & Readiness Scoring

Harness evaluates bankability across technical, financial, and market dimensions, calibrated to local realities.

Risk & Readiness Scoring

Harness evaluates bankability across technical, financial, and market dimensions, calibrated to local realities.

Risk & Readiness Scoring

Harness evaluates bankability across technical, financial, and market dimensions, calibrated to local realities.

Capital Matching

Projects are matched with aligned investors based on mandate, geography, risk appetite, and return expectations.

Capital Matching

Projects are matched with aligned investors based on mandate, geography, risk appetite, and return expectations.

Capital Matching

Projects are matched with aligned investors based on mandate, geography, risk appetite, and return expectations.

Ongoing Visibility

Investors track pipeline progress while developers strengthen readiness with built-in tools and insights.

Ongoing Visibility

Investors track pipeline progress while developers strengthen readiness with built-in tools and insights.

Ongoing Visibility

Investors track pipeline progress while developers strengthen readiness with built-in tools and insights.